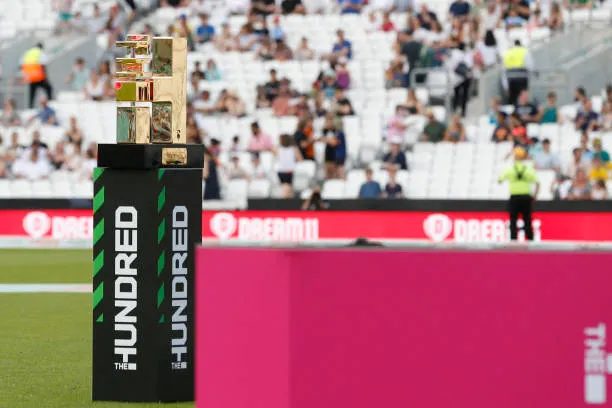

Franchise cricket has entered a bold new era, and the transformation currently underway in England’s The Hundred stands as a clear signal. With salary caps poised to rise sharply, the move towards an auction-style player market and the influx of global investor capital, the sport is shifting from a niche domestic competition into a commercially supercharged international model.

At the heart of this change is the decision by the England and Wales Cricket Board (ECB) to sell significant equity stakes in each of The Hundred’s eight franchises — raising more than £500 million in the process. These funds mark the arrival of deep-pocketed private investment in English cricket, akin to the valuations seen in other global sport leagues. With franchise values nearing £1 billion, the economics of the game are evolving fast.

One major outcome is a substantial increase to salary caps: the men’s teams in The Hundred will see their squad wage budgets nearly double, climbing from around £1.2 million to at least £2.1 million per side from the upcoming season. The women’s competition is also seeing a major uplift — the top-tier salary pool is set to expand significantly, offering six-figure contracts for leading players. These numbers shift The Hundred into a higher tier of franchise competition globally, narrowing the gap with elite leagues such as the Indian Premier League (IPL).

But the change isn’t just about money. The recruitment structure is also being overhauled. For the first time, The Hundred will adopt an auction model for player signings — moving away from a draft system and opening up bidding wars, multi-year deals and direct overseas player sign-ons. This replicates the template seen in the IPL and other major short-form competitions, placing players, franchises and markets into a genuinely global marketplace.

Together, the investment influx, wage escalation and market-based player recruitment represent a sea change. Franchise cricket is no longer a regional experiment — it’s becoming a global commercial product, one where brand value, media rights, player salaries and international star appeal dominate strategic thinking. England’s embrace of this trajectory signals that even traditionally conservative cricket markets are realising the need to scale up or risk being left behind.

However, the shift also raises questions and challenges. Higher player salaries and more aggressive recruitment mean greater financial risk and pressure on franchises to deliver return on investment. The expanded model puts strain on pathways, domestic structures and the broader sporting ecosystem — especially if grassroots and lower-tier cricket struggle to keep pace. There’s also the danger of player fatigue, congested schedules and a fractured global calendar as leagues increasingly compete for talent.

Nevertheless, the move appears deliberate and timely. As the competition for player attention, broadcast audiences and commercial partnerships intensifies worldwide, cricket’s franchise format is entering its next chapter. The Hundred’s evolving model may soon be replicated or challenged by rival leagues in other countries, accelerating a cycle of growth, consolidation and cross-border investment.

In short: franchise cricket is leveling up. England’s current reform of The Hundred is not just a makeover — it’s a strategic leap into the future of the sport. If executed well, it could position English franchise cricket among the world’s premier competitions. And for players, fans and stakeholders alike, the message is clear: the boundaries of cricket’s commercial frontier are expanding fast.

12BET Shortlisted for Sportsbook Operator of the Year at SBC Awards 2025